More Questions than Answers –

By: Larry Walker, Jr. –

Herman Cain argues that the reason we need his 999-Plan is because the tax law is too complicated. But is it really? I’ve worked with the tax law for 30 years, and I don’t think it’s all that complicated. It may have some complex calculations, mainly related to a few special write-offs and credits, but the basic bedrock of the Internal Revenue Code isn’t at all complex. Following Cain’s logic, if the tax law is so complicated that it needs to be “thrown out” and replaced, then isn’t our entire legal system similarly complex? If you answered yes, then why not just throw out the entire United States Code, shut down all courts including the U.S. Supreme Court, and just substitute the 10-Commandments. Would that work for you? If not, then why would you be in favor of Herman’s Cain’s overly simplistic 9-9-9 Tax Gimmick?

Business Taxes

Under present tax law, business expenses that are ordinary and necessary for the production of income are deductible for income tax purposes. The reason such expenses are deductible is because they represent taxable income to the recipient. There’s nothing really complicated about this. Expenses such as wages, advertising, office supplies, vehicle expenses, postage, legal and professional fees, commissions, rental payments, utilities, uniforms, travel, meals and entertainment, telephone usage, insurance, licenses, interest expense, benefits costs, retirement plan contributions and others, which are incurred for the production of income, are deductible for federal tax purposes. Although state and local governments are exempt from federal income tax, a deduction for state and local taxes is also allowed, under the theory that taxpayers should not be taxed at the federal level on taxes paid locally. All such expenses are likewise deductible in determining an entity’s profitability under general accounting principles. Where the law gets complicated, as far as business taxes are concerned, is when it comes to accelerated depreciation and general business credits.

Accelerated Depreciation

The reason fixed assets are depreciable is that each has a limited useful life, so the cost is spread over the life of the asset. For example, a computer has a useful life of 3 years, such that at the end of three years it generally needs to be replaced, so a business is allowed to write-off the cost over a three-year period. However, special gimmicks have been instituted over the years to accelerate the write-off of assets, such as the Section 179 deduction, and 50% or 100% bonus depreciation, whereby at least half or the entire cost may be written off in the year of purchase. If society wants to get rid of the accelerated depreciation loophole, then all that’s required is for the legislature to change the law back to regular straight-line depreciation. It doesn’t take a genius to figure that out, nor does it require throwing out the entire tax code.

General Business Credits

The other place that the law departs from reality is when it comes to tax credits. General business credits are special privileges which allow a company to receive direct tax credits over-and-above the normal deduction. For example, under the new Small Business Health Care Credit, where a business would normally be able to deduct the costs incurred for its portion of employee’s health insurance, a tax credit may now be taken over and above the regular deduction. Where it gets complicated is in determining which businesses qualify for the credit. In order to qualify a business can have no more than 24 full-time equivalent employees, and the average amount of wages paid per employee cannot exceed $49,999 per year. To obtain the maximum credit, a business can have no more than 10 full-time equivalent employees who are paid an average of less than $25,000 per year.

To determine whether one qualifies for the Health Care Credit, a business must be able to calculate the number of full-time equivalent employees and the average amount of wages paid based on complex formulas. Further complicating matters, the business must include and exclude certain types of employees and certain wages. Finally, if the business does qualify, it must subtract the amount of the tax credit from the amount of the normal deduction. For more on this, see Obamacare’s Effect on Small Business. If Americans wish to get rid of the smorgasbord of general business tax credits, it could be accomplished through legislation. It doesn’t take an Occupy Wall Street protest, or a 999-Plan to make this change. All that’s required is leadership.

Getting rid of accelerated depreciation and general business credits would go a long way toward tax simplification. Once accomplished, tax rates may be reduced to more tolerable levels. It doesn’t take a genius or a 999-Plan to accomplish this.

Problems with Cain’s 9% Business Flat Tax

The most egregious problem with Herman Cain’s plan involves wages. Under current tax theory, when a business pays wages, the employee bears the tax responsibility, not the business. But under Cain’s upside-down theory, businesses will not be allowed to deduct wages from gross income, unless they reside in empowerment zones. So in effect businesses will bear a 9% tax burden on the wages and salaries that they pay, and in addition employees will incur a 9% tax on the same. The double taxation of wages in the 999-Plan represents not only a huge departure from basic income tax theory, but from common sense.

Interest expense is currently deductible for income tax purposes as it represents taxable income to the recipient. But under Cain’s theory, interest will no longer be deductible by the borrower, yet it remains taxable to the lender. This is also an extreme departure from common sense. Under Cain’s theory, a corporate officer who loans money to a majority owned company would be taxed on the interest income received, while his company would incur a 9% tax on the same. Who wants to pay a 9% tax on the interest paid to banks and other lenders? It’s not personal, it’s the principle…

Contributions to employee retirement plans are currently deductible for income tax purposes, because they represent future taxable income to the recipient. But under Cain’s plan, company contributions to retirement plans are apparently not deductible for tax purposes. In effect businesses will bear a 9% tax on such contributions and the recipient will bear another 9% tax upon the withdrawal. Again, this form of double taxation represents an extreme departure from basic income tax theory.

Employer paid health insurance premiums are currently deductible for income tax purposes, and not counted as income to employees, although theoretically it should be taxable to employees. But under the Cain plan, employer paid health insurance premiums will apparently not be deductible. In effect, employers will pay a 9% tax on top of the amount paid towards employee’s health insurance benefits. So an employer will be taxed whether or not it provides health benefits. Since there won’t be any incentive for providing health care coverage under the 999-Plan, what will occur? Will companies continue to pay for health benefits plus 9%, or will they just keep the money and pay the 9%? Absent any other requirements, what would you do?

9% Business Flat Tax

“Gross income less all purchases from other U.S. located businesses, all capital investment, and net exports.”

Since Cain doesn’t define the term, “purchases”, what exactly does the above statement mean? Volumes could be written to define this simple statement. For example, does the term “purchases” include services or is it limited to products? If a company buys supplies such as paper and toner, from other U.S. based businesses, are these items deductible, or does deductibility only apply to purchases of goods for resale? If a company employs the services of another business, are such services deductible as purchases? I only ask because if that’s all there is to the proposed tax code, then it’s not clear whether this statement applies to the purchase of services, goods at retail, goods at wholesale or all of the above.

Retail businesses presently buy goods at wholesale, paying no sales tax upon the purchase, but then charge sales tax upon resale. However, service companies buy their supplies at retail; as such products are for internal use and not for resale. Services are not subject to sales tax at the State level, but will they be under the 999-Plan? Will both retailers and service businesses have to pay the 9% national sales tax on U.S. purchases, or are retailers exempt, or are both exempt? If both types of businesses have to pay the national sales tax, then even if such purchases are deductible for income tax purposes, they will have already been subject to a 9% national sales tax upon purchase. The point is that the first half-sentence of Cain’s proposal, by itself, necessitates a myriad of rules, regulations and definitions.

“For if the trumpet gives an uncertain sound, who shall prepare himself for the battle?” ~1 Corinthians 14:8

Next, according to Cain, the amounts spent on capital investments will be deductible under his 999-plan. But Cain doesn’t define what he means by the term, “capital investments”. Although he has publicly referred to this passage as meaning the purchase of equipment, he hasn’t defined any limitations. Does this apply to new or used equipment, or both? Capital assets include all tangible property which cannot easily be converted into cash and which is usually held for a long period, including real estate, equipment, etc. Under current law, buildings and other commercial real estate are generally depreciable over a 39 year lifespan, while land is never depreciable. But since Cain doesn’t go into detail, and because he wants to “throw out” the current tax code, we have to ask, will a business be able to write-off the purchase of real estate including land, in full, in the year of purchase? Are there no limitations? Here are some more questions:

-

If the purchase of capital equipment causes a company to have a net operating loss, can the loss be carried backwards and forward like under current law?

-

Is the purchase of stock in another business considered to be a tax deductible capital investment under the 999-Plan? The purchase of stock would be treated as an asset and not as a deductible expense under current law, but would it be treated simply as a deductible expense under the Cain plan? He doesn’t say.

-

Will there even be such a thing as a balance sheet under the new 999-plan, or will businesses simply need to account for gross income, purchases from U.S. businesses, capital investments, imports and exports?

-

Under the 999-Plan, purchases from non-U.S. located businesses are discouraged. So does the term “purchases” include the purchase of capital equipment? If capital assets are purchased from overseas companies, will they be deductible because they are capital investments, or will they not be deductible due to the “purchases from other U.S. located businesses” clause? Again, it’s not clear.

Net exports are also excluded from the proposed 9% business tax. So it would follow that a U.S. based business, which sells more of its goods overseas than in the U.S., would be exempt from taxes. Thus businesses are encouraged to export their goods and services, which might be beneficial to large manufacturers or retailers, but not to small service based businesses which make up the bulk of the American economy. Does a U.S. company have to be based in the U.S., where it would employ American workers, in order to receive the exemption, or can it open an operation in Mexico, sell its goods there and escape the 9% tax? Cain doesn’t provide any details on the exemption for net exporters either.

“Empowerment Zones will offer deductions for the payroll of those employed in the zone”

Under the 999-Plan, labor intensive companies would not receive a deduction for wages, unless located in empowerment zones. With wages being the bulk of gross income for many service sector businesses, under Cain’s 999-Plan it is possible for a business to have zero or negative income, according to generally accepted accounting principles, and still owe taxes. Also, in spite of the proposed repeal of Social Security, Medicare, and (I guess) Federal Unemployment, since these taxes were previously deductible for income tax purposes, the full effect of their elimination is somewhat mitigated. In other words a business can breakeven, and still wind up having to borrow money at the end of the year in order to pay a tax bill. So will more businesses simply relocate to empowerment zones under Cain’s plan, or will some just get the short end of the stick while others receive a big fat special interest type government subsidy?

“That dog won’t hunt.” ~Herman Cain

Non-Deductible Business Expenses under the 999-Plan

- Wages paid outside of empowerment zones

- State and local taxes

- Federal and State and Local Licenses

- Purchases from foreign based companies

- Mortgage Interest Expense?

- Business Interest Expense?

- Retirement Plan Contributions?

- Health Insurance Premiums?

Example 1

The following small business corporation has a single-owner, is labor intensive, and is not located within an empowerment zone. As you can see, in the example below, the company has net income of -0- under current law, and net income of 8,088.50 under the 999-Plan. This is attributable to the elimination of payroll taxes which were also deductible for income tax purposes. The company has taxable income of -0- under current law, but would have taxable income of $128,318 under the 999-Plan. This is attributable to its deductions being limited to capital investments and purchases from other businesses, versus all ordinary and necessary expenses.

Thus, where Federal, State, and National Sales taxes are all -0- under current law, they would be $21,199.08 (11,548.62 + 7,999.08 + 1,951.38) under the 999-Plan. When the total business taxes are subtracted from net income, after-tax income is -0- under current law, but would be negative (-13,110.58) under the 999-Plan. So the owner will either need to borrow money to pay the taxes, or add money from personal accounts to shore up the company. Let’s hope that the 9% Individual Flat Tax leaves the owner with enough to cover the company’s shortfall.

9% Individual Flat Tax

“Gross income less charitable deductions”

Most of us know what the term “gross income” means, but what does it mean under the 999-Plan. If an individual has a sole proprietorship, will they be taxed on gross income and not be allowed to deduct ordinary and necessary business expenses? Will those who own rental properties pay a 9% tax on gross rental income without the benefit of deductions for mortgage interest, real estate taxes, insurance, repairs and depreciation? Will employees who incur substantial unreimbursed employee expenses be denied the benefit of deducting such costs?

-

Since there won’t be a deduction for state and local taxes, including real estate taxes, one will in effect pay a 9% tax on the amount of State taxes paid.

-

Since there will no longer be a deduction for mortgage interest, there won’t be any incentive to payoff an existing mortgage. Homeowners will in effect be paying a 9% tax on the amount of mortgage interest paid. Won’t this cause more families to simply abandon their houses for rentals? Will the plan push us from a private ownership to a public or corporate ownership society?

-

Since there is no deduction for the amount of national sales taxes paid, taxpayers will in effect pay a 9% tax on the 9% national sales tax as well.

-

Since there is no deduction for retirement plan contributions, taxpayers will pay a 9% tax on contributions and another 9% on the same money when the funds are withdrawn. If one currently owns a ROTH retirement plan will they receive an exclusion from the 9% tax when the funds are withdrawn?

-

Will life and disability insurance proceeds, which are currently exempt, be subject to the new tax?

-

Since the 9% Individual Flat Tax doesn’t distinguish between being married, single, widow, widower, or having one child or ten, what will our society look like after this plan is implemented? Will the population decline, as the cost of raising children is penalized? Will there be fewer marriages?

“Empowerment Zones will offer additional deductions for those living and/or working in the zone”

In other words, it’s not a flat tax after all; it’s a flat tax with exceptions for certain special interest groups. If businesses and citizens race to occupy today’s empowerment zones, will they eventually cease to be empowerment zones? And if no one takes the bait, and the masses instead flee from empowerment zones, what then? Will the government start issuing refundable tax credits, like it does today? Will the plan then become known as the +9, -9, +9, +9 Plan? That’s a 9% flat business tax, a 9% refundable tax credit, a 9% flat individual tax, and a 9% national sales tax.

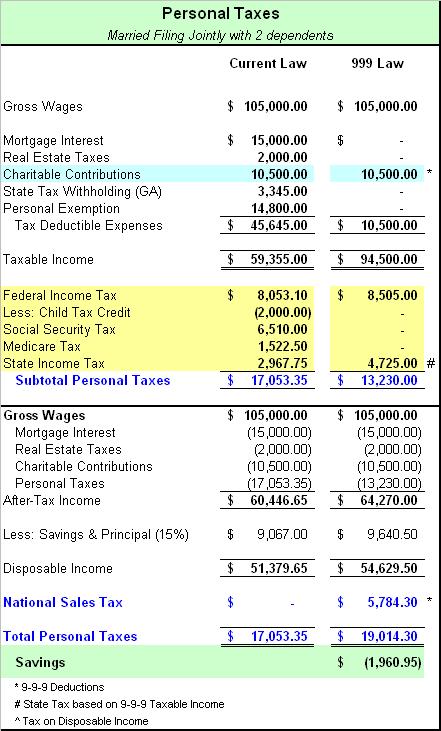

Example 2

In the example below, individual income taxes are calculated on the owner of the small business corporation in Example 1. The owner is married with two dependents and the only income is wages paid by the company. The taxpayer pays mortgage interest, real estate taxes, state income taxes, and makes charitable contributions as shown in the table below. Under current law, taxable income is $59,355 versus $94,500 under the 999-Plan. That’s because the only item deductible for tax purposes under the 999-Plan is charitable contributions. Thus Federal income tax under current law would be $6,053.10 (8,053.10 minus a child tax credit of 2,000), and $8,505 with the 999-Plan. Although the taxpayer saves $8,032.50 under the 999-Plan by not having to pay Social Security and Medicare taxes, State income taxes would be higher, unless all states with an income tax rewrite their revenue codes, simultaneously.

Thus, after-tax income would be $60,446.65 under current law, and $64,270.00 under the 999-Plan, but that’s before paying the 9% national sales tax. If we subtract out 15% of after-tax income as savings and principal repayments on loans, that leaves the taxpayer with disposable income of $51,379.65 under current law, and $54,629.50 under the 999-Plan. Disposable income is the amount that a taxpayer will spend on items subject to the 9% national sales tax. After allowing for the national sales tax of $5,784.30, the taxpayer will wind up paying $1,960.95 more in taxes under the 999-Plan than under current law. So unfortunately, this small business taxpayer will not save enough on personal taxes under the 999-Plan to compensate for the businesses shortfall of $13,110.58. But how many people own small businesses anyway? More than you can imagine. Does it get better for companies with more than one employee? No. It would only get better if the business and its owner relocated to an empowerment zone.

9% National Sales Tax

“Unlike a state sales tax, which is an add-on tax that increases the price of goods and services, this is a replacement tax. It replaces taxes that are already embedded in selling prices. By replacing higher marginal rates in the production process with lower marginal rates, marginal production costs actually decline, which will lead to prices being the same or lower, not higher.”

Once again, volumes could be written to define this overly simplistic statement. Cain has stated publicly that the national sales tax will be levied on the purchase of new houses, cars and other goods, but not on used items. When we were discussing this, someone in my office fired off, “So should I just start buying my clothes from Goodwill?” Why would anyone want to buy a new house if it will cost 9% more? A new $200,000 home would cost $218,000 under Cain’s plan. On face value, that doesn’t mesh with prices “being the same or lower” to me. This means that where a 10% down payment is required, that instead of looking at $20,000, a buyer will now have to come up with $21,800. And since the interest expense will no longer be deductible, what’s the point anyway? One wonders if there will even be any homebuilders left if this plan were to somehow pass.

A brand new $40,000 vehicle would cost $43,600 under Cain’s law, and that’s not including state and local tax, tag, and title. Most Americans can’t afford the former, so why would the latter be an improvement? So even if underlying prices remain the same under the 999-Plan, prices will, at the minimum, rise by 9%. The 999-Plan would only lead to an increase in used car sales, and a decline in automobile production.

Marginal production costs might decline for businesses that are not labor intensive, make all their purchases from U.S. suppliers, or are located in empowermnet zones; but what about labor intensive businesses, those dependent on foreign suppliers, and those located outside of empowerment zones? Under the 999-Plan, it is possible for a business to have a net loss and still owe taxes. As shown in Example 1, if a business spends 70% of its gross income on wages, and the rest on tax deductible expenses, even though it has no profit, it would still owe a 9% tax on the amount of wages paid. Thus where a business would have owed no taxes under present law, it may owe under the 999-Plan, which will drive up, not lower its production costs.

Eliminates double taxation of dividends –

If I heard Cain correctly, corporations would be able to deduct the amount of dividends paid, before computing taxes, so that dividends are only taxed once at the individual level. That’s a good thing, but if the current tax code is simply “thrown out”, and the IRS is shut down, what’s to prevent corporate officer’s from taking all, or most, of their compensation in the form of dividends instead of wages? Since wages won’t be deductible at the corporate level and dividends will, you can bank on this loophole being blown wide open.

Features zero tax on capital gains and repatriated profits –

No tax on capital gains? That reminds me of that old Better Business Bureau film entitled, “Too good to be true.” Yeah, if it sounds too good to be true, it probably is. Just like with dividends, if there is no longer an IRS, and if the current tax code is “thrown out”, what’s to prevent corporate officers and employees from being paid in stock, rather than wages, and then cashing in on tax-free capital gains later?

Also, since charitable contributions are the only deduction allowed under the 9% Individual Flat Tax, what happens with capital losses? Will capital losses be deductible against ordinary income, only against capital gains, or not deductible at all? He doesn’t say. So when Cain “throws out” the current tax code, and shuts down the IRS, who will write the new code? Will there be some kind of 999 Super Committee, charged with coming up with new tax theories, while barred from referencing the previous code?

Not taxing repatriated profits sounds good, but it also provides an incentive for companies to relocate overseas. So it’s either Mexico, or an empowerment zone, eh? Flip a coin. Although some have advocated for such a measure in lieu of another stimulus, no one was saying that it should be a permanent pillar of U.S. tax policy. Cain has merely picked up on a popular topic and wrapped it into what I would call basically a sham.

“Let’s get real.” ~Herman Cain

Okay, let’s get real. Cain is light on specifics, so one is resigned more to asking questions than analyzing data. It all sounds good on television, but the plan appears to be constructed mainly out of neat little sound bites designed to appeal to weak-kneed conservatives, rather than out of substance. Yes I am an accountant, and I am for simplifying the tax code, but I can’t go along with a plan that lacks common sense. In my opinion, we shouldn’t throw out our current tax code in favor of a poorly constructed plan, instigated by someone who knows nothing about income taxes. Herman Cain may know how to turnaround a pizza parlor, and he was a great local talk show host, but an accountant or economist he’s not.

Anyone serious about simplifying the tax code should be talking about the following:

- Eliminating accelerated depreciation

- Eliminating general business tax credits

- Eliminating personal tax credits

- Eliminating the alternative minimum tax

- Lowering marginal income tax rates

That would be a good start. If you don’t think that eliminating the above and lowering tax rates would greatly simplify the income tax code, then you don’t know anything about income taxes.

If the 999-Plan were to somehow miraculously survive a left-wing insurrection, how would the 43 States that have an income tax calculate their taxes? Since most of the States begin with federal adjusted gross income and allow federal itemized deductions, and since under the 999-Plan federal adjusted gross income is simply gross income, and itemized deductions are limited to charitable contributions, then won’t all States have to rewrite their tax codes as well? States will have to decide whether they want to allow deductions for mortgage interest, property taxes, and other expenses which are currently deductible, and if they don’t, then the burden of State taxes will rise, further diminishing the effect of the 999-Plan.

Finally, since the 999-Plan interferes with or supplants other federal laws, it will necessitate repeal of the Federal Insurance Contributions Act, and involve drastic changes to how Social Security and Medicare benefits are calculated. Will Social Security benefits be based on gross income, whether earned or unearned? Will future benefits simply come out of the general fund? If so, then will paying social insurance benefits out of the general fund put a strain on the rest of the federal budget, leading to tax hikes in the future? Will the Federal Unemployment Act also be repealed, since it is part of the payroll taxes employers pay?

There’s more to 9-9-9 than 9-9-9. As far as I’m concerned, the 999-Plan is a total sham, and because Herman Cain has staked his entire campaign on it, he’s not fit to be President of the United States. What America lacks is leadership. Offering to lead the nation down an unproven, untested, and unsound path is no different than what we have today. What most of us want to hear from prospective presidential candidates is what will replace Obamacare, which regulations will be repealed, how the size of government will be reduced, and how the federal budget will be balanced. Herman Cain’s 999-Plan is nothing more than a diversion, designed to win a primary and lose an election. If you want four more years of Obama, then vote for Cain.

“WHEN THE FOLLOWERS ARE READY, THE LEADER WILL APPEAR.”

References:

Larry, you'll never get it…you're too negative bro. You do not compute that corporations will be paying significantly LOWER TAX RATES and that items will cost at least 10 to 22% less, since the embedded taxes are removed from items priced for resale. Plus, the country needs jobs and this reform would create millions of new taxpayers and the sales tax will make everyone a taxpayer..and the politicans would be defanged…goodbye crony capitalism and “pay for play”.

LikeLike

I'm too negative? I admit that I don't get that aspect. I don't understand how embedded taxes are removed from the items priced for resale, and I don't see how items will cost 10 to 22% less under this plan. Since taxes will increase for 84% of the population, including many companies, I don't see where there will be any savings which will result in price reductions. Will wholesalers somehow be exempt from taxes under this plan? Cause that's the only way prices will decline. I showed some example here, and ran some others not shown, and the math doesn't work, for me anyway. But what do I know?

LikeLike

“…taxes for the wealthy would drop considerably under Cain’s proposal. The Tax Policy Center projects in 2013, the first year the Cain plan could be enacted, 95 percent of people making $1 million or more would get a tax cut that averaged $487,300.”

“By way of comparison, only 16 percent of people making between $50,000 and $75,000 a year would get a tax cut, averaging $1,959. At least 70 percent of people in this middle-income category would see their average federal taxes rise by $4,326.”

And that’s why I call it a “Sham”. It’s not what it portends to be.

http://www.csmonitor.com/USA/Politics/2011/1026/Which-GOP-flat-tax-plan-is-fairest-of-them-all

LikeLike

Pingback: 3rd Concern with the 9-9-9 Plan | Black and Center