Saving $1,756 Billion, Overnight –

By: Larry Walker, Jr. –

“There is no doubt that many provisions in the Tax Code benefit narrow groups of taxpayers, but the dirty little secret is that the largest special interests are us – the vast majority of U.S. taxpayers. Virtually all of us benefit from certain exclusions from income, deductions from income, or tax credits.” ~National Taxpayer Advocate

According to Article I, Section 7 of the United States Constitution, “All Bills for raising Revenue shall originate in the House of Representatives; but the Senate may propose or concur with Amendments as on other Bills.” And, according to the 16th Amendment to the Constitution, “The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

Thus Congress has the power to pass spending bills, and a responsibility to collect taxes on incomes; however the pair should be administered by separate agencies. Anyone with a background in accounting or auditing knows that an adequate internal control system should include proper authorization and segregation of duties. By granting the IRS the dual responsibilities of administering social welfare payments and collecting taxes, Congress has left the door wide open for ineffable fraud.

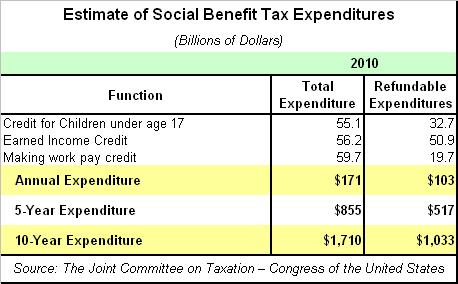

Since at least 1975, a growing portion of social welfare spending, now to the tune of $1.7 trillion over a 10 year period, is introduced by congressional tax-writing committees and administered by the Internal Revenue Service. Such manipulation has introduced government spending policy into what otherwise would be an exercise in economic measurement. Tax expenditures, by way of refundable credits, represent a deviation from the “tax base”, introduce complexity into the tax law, and impose a spending function on an agency best suited to revenue collection.

Delivering Social Benefits through the Tax System

In the 2010 Annual Report to Congress, National Taxpayer Advocate Nina E. Olson focused on the need for tax reform as the No. 1 priority in tax administration. In particular, she has focused on the problem of delivering social benefits through the tax system, which complicates the mission of the IRS, resulting in a dual mission of welfare administration as well as revenue collection. Elsewhere in the report, the National Taxpayer Advocate recommends that the IRS adopt a dual mission statement and hire personnel appropriate to the delivery of social benefits that already have been codified.

Okay, so let’s stop playing games. Nobody wants to get rid of deductions for mortgage interest, state income taxes, medical expenses, charitable contributions, employee business expenses, or ordinary and necessary business expenses. And as far as officially expanding the mission of the IRS, to social welfare appropriator, on top of being the tax collection arm of the government, we don’t even need to go there. So let’s just cut to the chase. The main problem with the income tax code, today, can be found among three refundable tax credits, at the individual level.

It is important to note that neither of the following are what their names imply: The Earned Income Credit, Child Tax Credit, and Making Work Pay Credit (now known as the 2% Payroll Tax Cut) are not tax credits at all; they are merely social welfare giveaways, administered by the IRS. For the most part, neither represents a refund of income taxes actually paid, as such refunds, when combined, are well in excess of the total amount of taxes paid, including in many cases Social Security and Medicare withholding. Common sense dictates that one cannot refund something which has never been received.

-

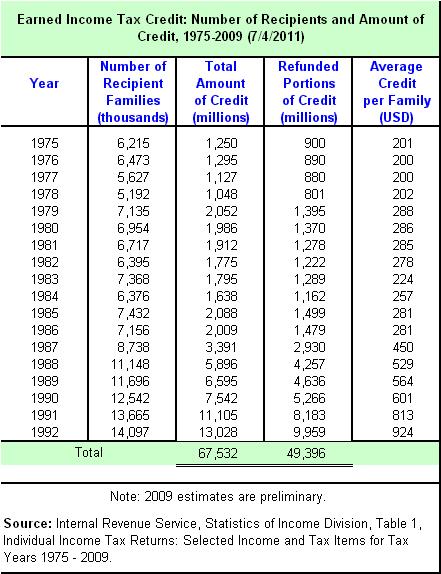

The Earned Income Credit (EIC) was signed into law by President Gerald Ford in 1975. The function of the EIC was to offset the burden Social Security taxes placed on low-income filers with children, and to motivate them to work. The earned income credit has grown to be one of the principal antipoverty programs in the federal budget. The only problem is that it is not a part of the federal budget. In 1975, 6.2 million families received an average credit of $201. In 2009, 27.3 million families received an average credit of $2,206.

-

The Child Tax Credit (CTC) was enacted as part of the Taxpayer Relief Act of 1997. Congress established the child tax credit to address concerns that the tax structure did not adequately reflect a family’s reduced ability to pay taxes as family size increased. Initially, for tax year 1998, families with qualifying children were allowed a credit against their federal income tax of $400 for each qualifying child. For tax years after 1998, the credit increased to $500 per qualifying child, and was refundable for families with three or more children. The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) increased the credit to $1,000 per child beginning in 2003, and extended refundability to families with fewer than three children. It is one thing to want to help lower the income tax burden of families, but entirely another when the burden is reduced below zero.

-

The Making Work Pay Credit (MWP) was enacted as part of the economic stimulus act (“American Recovery and Reinvestment Act of 2009,” or ARRA). The purpose of the credit is to offset part of the Social Security taxes paid by low- and middle-income workers. MWP provided a refundable tax credit equal to 6.2 percent of earnings (the employee share of the Social Security payroll tax), up to a maximum credit of $400 for individuals ($800 for couples). Couples could claim the full $800 credit, even if only one spouse worked.

Can you say redundant? So let me get this straight – The EIC was implemented to offset the burden Social Security taxes placed on low-income filers with children, and to motivate them to work. The CTC was established to address concerns that the tax structure did not adequately reflect a family’s reduced ability to pay taxes as family size increased. And the MWP was enacted to offset part of the Social Security taxes paid by low- and middle-income workers.

If Social Security and Medicare taxes are collected from all workers, on an equal basis, in order to pay for future benefits, then shouldn’t the act of granting some citizens a premature distribution, of the same, result in a reduction of future benefits? Common sense says it should, but that’s not how this works. Under each of the above tax credits, some citizens are given back all of their Social Security and Medicare payroll contributions, and a portion of their employer’s contributions, and yet they are eligible to reap the full amount of future benefits based on the amount of their rebated contributions.

What’s wrong with this picture? Again, common sense would dictate that, if you don’t put anything into the pot, then you don’t get anything out. And if you put something into the pot, then you should have to wait until age 62, 65, or 67 to obtain a benefit, just like everyone else.

“Don’t be misled–you cannot mock the justice of God. You will always harvest what you plant.” ~Galatians 6:7

Today, the United States is reaping exactly what it has sown. We have a $15 trillion national debt, a $1.5 trillion annual budget shortfall, and social entitlement programs on the verge of bankruptcy. But instead of balancing the budget, reducing the debt, and placing money into trust funds to cover future liabilities, we are giving millions of low-income families a double benefit. First, they are given refundable credits, absolving them from any stake in the future of this nation, and then they are promised benefits in the future, benefits which will be paid for entirely at the expense of others.

If the government wants to provide public assistance benefits for low-income filers with children, and motivate them to work, it should accomplish this through one of its other redundant agencies, it doesn’t need to use the tax code. The refundable tax credits, listed above, are precisely the kind of social welfare expenditures that have no place in tax administration.

According to the Law of Nature, “You will always harvest what you plant.” But as far as the federal government’s logic goes, justice would seem to dictate that either someone else will harvest what you plant, or you will harvest what someone else plants. It’s not even clear, to most American’s, how much is actually being squandered in this seemingly everlasting war on common sense.

Free Money

According to the Joint Committee on Taxation, in 2010, the IRS gave away $55.1 billion by way of the Child Tax Credit, $56.2 billion via the Earned Income Credit, and $59.7 billion through the Making Work Pay Credit. That’s a total of $170.9 billion in a single year, $103 billion of which was refundable. Over a 10-year period, we’re talking about $1.7 trillion in tax credits, just over $1 trillion of which is refundable.

Note: Although the MWP expired at the end of 2010, it was replaced with the 2% Payroll Tax Cut beginning in 2011, as part of the Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010. The new credit allows for a 2% cut in payroll taxes for employees, which reduces the Social Security Tax from 6.2% to 4.2%, without affecting Social Security benefits. When combined with the EIC and CTC, millions of citizens will receive future benefits without having made adequate contributions. No wonder Social Security is on the verge of bankruptcy.

The federal government has thus, not only come up with a way of returning to millions of Americans the full amount of their social security contributions, but an amount well in excess, since millions of households are eligible to receive all three tax credits. Another major flaw, in all of this activity, is that eligibility for the premature distribution of Social Security benefits doesn’t disqualify or limit any of these tax filers ability to receive other Federal and State social benefits (i.e. Public Housing, Medicaid, Food Stamps, and Temporary Assistance for Needy Families).

If the federal government insists on granting relief to “qualifying” citizens through the tax code, then under no circumstances should such tax credits be refundable. As I stated in Part I, “I think it’s enough to not owe any federal income taxes at all. The concept of transferring one man’s tax payment directly to another taxpayer is most detestable, and unnecessary.”

Keep in mind that the refundable tax expenditures above represent amounts over and above the amount of tax initially collected from the affected taxpayers. Thus, these are not income tax refunds at all, they are social welfare payments, confiscated from taxpayers, and handed over to non-taxpayers through the tax code.

Does the act of filing a tax return make one a taxpayer?

The reality is that a great number of tax returns are filed simply to receive refundable tax credits. If there were no refundable tax credits, then it is conceivable that several million tax returns would not need to be filed. And, if millions of citizens were excluded from filing income tax returns, then that would aid in reducing the size of the IRS, and thus the size of government. Isn’t this what most conservatives want?

That brings us to the following questions: How many tax returns are filed each year simply to obtain refunds in excess of taxes actually paid? And, how much money is being squandered in floating social welfare programs through the tax code?

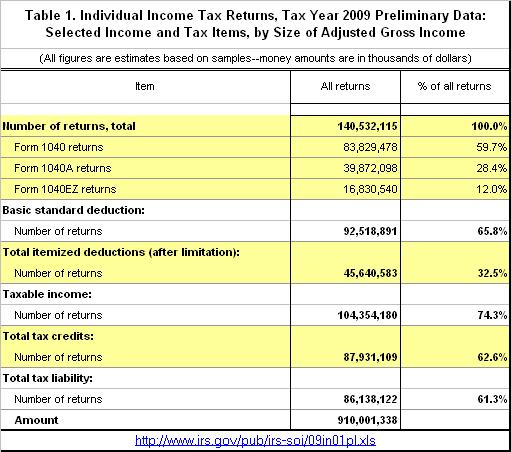

First of all, these days we hear a lot of people whining about the tax code being too complex, so in Part I, we asked the question: How complicated is your tax return? To bring the numbers up to date, we checked the IRS 2009 Data Book (preliminary). We found that for tax year 2009, out of the 140,532,115 individual tax returns filed, only 59.7% filed the more challenging long-form 1040, while 28.4% filed the short-form 1040-A, and 12% filed a simplified form 1040-EZ (see table below). So from this we can see that 40.4% of Americans, who filed 2009 tax returns, filed fairly simple forms.

The data also shows that 65.8% of filers, 92,518,891 out of 140,532,115, utilized the basic standard deduction, while only 32.5%, or 45,640,583, itemized their deductions. It is a fact that only 74.3% of the returns filed contained taxable income, and just 61.3% resulted in an income tax liability. Meanwhile, the majority, 62.6% of filers, claimed tax credits.

With 65.8% of taxpayers claiming the standard deduction, 62.6% claiming tax credits and 40.4% filing simple tax forms, there is potential to eliminate the filing requirements for perhaps as many as 56,702,628 households (the lowest common denominator).

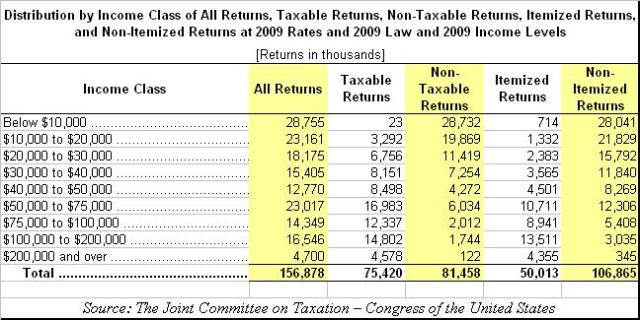

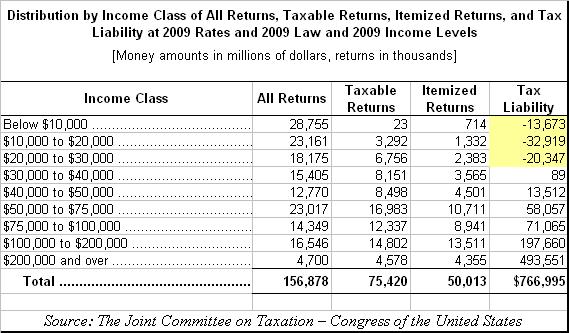

The following table was derived from estimates published by the Joint Committee on Taxation (JCT). You will note that the JCT data reflects the total number of returns as 156.8 million, versus the IRS report of 140.5 million. The reason for the difference is that the JCT estimate includes both filing and non-filing tax units. Non-filing tax units include individuals with income that is exempt from Federal income taxation (i.e. transfer payments, interest from tax-exempt bonds, etc…). Note: The JCT data also excludes individuals who are dependents of other taxpayers and those with negative income.

From this, we can conclude that at least 16 million persons, with positive income, are not required to file income tax returns. This is not complicated to follow. Generally speaking, if a taxpayer’s income is less than the applicable standard deduction, and personal and dependency exemptions, then they are generally not required to file a return. The only reason that a return would be filed, when one is not required, would be to obtain a refund of an overpayment of tax withheld, or to receive a refundable tax credit.

From this data we also learn that 81,458,000 out of the 156,878,000 returns, or 51.9%, were considered to be non-taxable. We can also see that 106,865,000 returns out of the total of 156,878,000, or 68.1%, did not itemize deductions.

Thus, from the perspective of the US Congress, there should be room for the elimination of additional pointless compliance. Since 16 million Americans were already eliminated from annual filing rites, what would be wrong with exempting several more million, especially those who take out of the tax system more than they put in?

The next chart (above), also from JCT data, shows the distribution of income tax liability by income class. From this, we can see that most of the returns filed, with less than $30,000 in annual income, had negative tax liabilities. In fact, only 10,071,000 returns out of 70,091,000, or 14.4% of those with income under $30,000, were taxable, while 85.6% were non-taxable.

Even more striking is that the returns in this income category had a cumulative negative tax liability of $66.9 billion. We may further infer that almost all of the $71.5 billion in taxes, paid by those who made between $40,000 and $75,000 per year was collected for the sole purpose of being redistributed to those who made less than $30,000.

I submit that the mission of the Internal Revenue Service ought to be to collect what is required to fund the federal government, not to redistribute funds received from some taxpayers directly to others. The fact that federal revenue is being spent before the funds ever hit the US Treasury’s coffers should be alarming.

What should be clear is that removing the filing requirement for approximately 60,020,000 (70,091,000 – 10,071,000) taxpayers would result in federal savings of at least $66.9 billion per year ($669 billion over 10 years). Since the tax code already eliminates the filing requirement for 16,000,000 persons, the potential exists to exclude an additional 44,000,000 (60,020,000 – 16,000,000). But that’s not the end of the story.

Exponential Growth of the EIC

The following table, derived from the IRS 2010 Data Book, shows that in the first 18 years after implementation of the Earned Income Credit, from 1975 to 1992, the IRS expended a total of $67.5 billion, $49.4 billion of which was refundable.

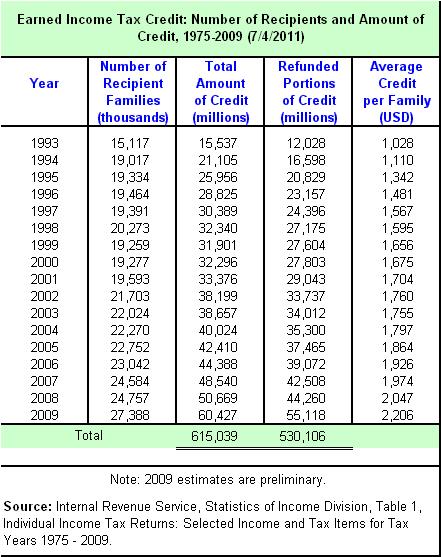

The next table, derived from the same data book, shows that in the subsequent 17 years, from 1993 to 2009, the IRS gave away a total of $615 billion through the EIC, $530 billion of which was refundable. So the amount of EIC spending grew nearly 10-fold in the second period.

The Earned Income Credit has thus grown from initially giving 6.2 million families an average tax credit of $201, in 1975, to granting an average credit of $2,206 to some 27.3 million families, in 2009. With the current level of spending in excess of $60 billion per year, the IRS will give away more, on the EIC, in the next 10 years, than was spent in the first 35 years of the program. Will the spending ever end?

Waste, Fraud, and Abuse

Social benefit programs add complexity to the tax code and represent a large part of tax expenditures, or government spending structured through the revenue system. To address the complexity and other implications of tax expenditures, the National Taxpayer Advocate has recommended, “adoption of a process to evaluate whether a tax expenditure presents an administrative challenge, and if so, the extent to which it achieves its intended purpose”.

I would contend that the answers to her questions are self-evident, and further evaluation is unnecessary. For had the Earned Income Credit been sufficient, then there would have been no need for the Child Tax Credit, the Making Work Pay Credit, or the 2% Payroll Tax Cut. Thus neither program has been effective. Their only accomplishment, thus far, has been to aid in the accumulation of $15 trillion in government debt, a $1.5 trillion budget deficit, and a downgrade to our national credit rating.

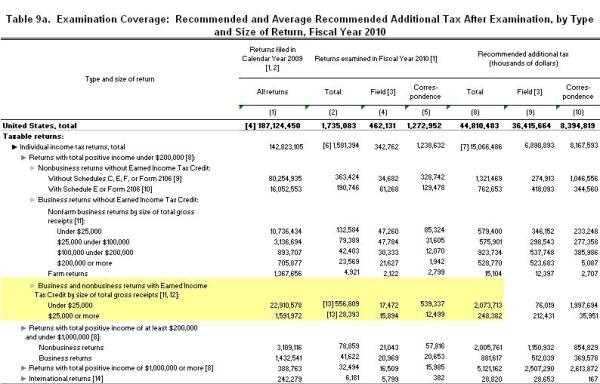

The IRS 2010 Data Book reveals that, in fiscal year 2010, 37% of the 1,581,394 individual returns audited by the IRS, involved the Earned Income Credit (above – click to enlarge). Among these, 556,809 returns had adjusted gross income below $25,000, and 28,393 reported adjusted gross income greater than $25,000. These EIC audits resulted in the recommendation of $2.3 billion in additional taxes.

Thus, eliminating the Earned Income Credit will not only save the federal government $60 billion per year (or $600 billion over 10 years) in tax expenditures, but it will eliminate the needless filing and processing of millions of returns, and reduce the number of audits by 37%. That’s significant in and of itself, but when we tack on elimination of the Child Tax Credit and Making Work Pay Credit (2% Payroll Tax Cut), we are talking about total savings of $855 billion over 5 years, or $1,710 billion over 10 years.

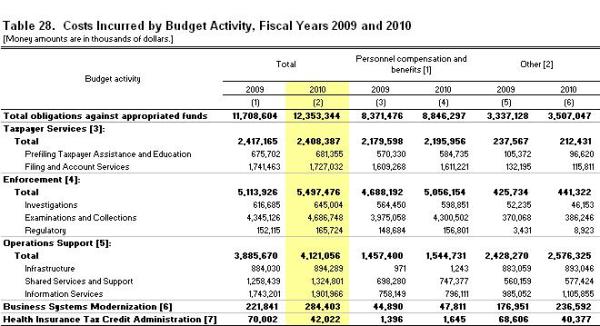

In addition, Table 28, of the 2010 Data Book (above – click to enlarge), shows that the IRS expended a total of $12.4 billion in its fiscal year 2010 operations. Thus elimination of the EIC, on its own, would allow the IRS to reduce its size by 37%, saving taxpayers an additional $4.6 billion per year ($46 billion over 10 years). Add that to the savings realized through elimination of the social welfare benefits associated with the EIC, CTC and MWP and this proposal will save the federal government $1,756 billion over the next 10 years. That’s more than three times my original goal. Problem No. 1 solved.

So what’s the bottom line? The administration of social welfare benefits through the tax code should be suspended immediately. By so doing, Congress will eliminate the unnecessary annual filing of more than 40 million tax returns, save the federal government $1,710 billion in tax expenditures, reduce the budget of the IRS by $46 billion, and will accomplish all of this without raising taxes, or eliminating critical spending programs.

References:

The Joint Committee on Taxation – Congress of the United States

National Taxpayer Advocate – 2010 Annual Report to Congress: Volume 2

Related:

Study: Michigan among states scaling back low-income tax credits

Great post!

LikeLike

Thanks! – I'll keep your website on file for referrals.

LikeLike

Pingback: Trump’s Dynamic Tax Policy | Black and Center

Pingback: 2016 Conservative Tax Plans: Trump vs. Carson | Black and Center

Pingback: Top GDP Growth Rates in U.S. History | Black and Center

Pingback: Affordable Care Excise Tax, Part III | Black and Center

Pingback: The Malaise of 2012 | Part II | Black and Center

Pingback: Endless Stimulus | Payroll Tax Cut | Black and Center

Pingback: Tax Simplification, Part I | Black and Center