Untimely and Proven to Fail

By: Larry Walker, Jr.

Near the end of 2007, prominent economists began advising the federal government that the economy was heading into a recession. They also mistakenly advised that the recession could be avoided if the government were able to implement some kind of economic stimulus program. In order to work successfully, such a stimulus needed to be large, targeted, and timely. Tax refund checks needed to reach taxpayers in a matter of weeks not months. Economists must have forgotten that they were dealing with the federal government.

Recessions are a normal part of the business cycle. The U.S. has averaged a recession about once every five years since WWII. Although economists have gotten better at predicting business cycles, it’s fairly clear that no one has ever been able to sidestep a recession. Avoiding a recession is like trying to stop an oncoming hurricane, when you see it coming you get out of the way, wait for the storm to subside, and then focus on recovery.

An economic stimulus package was proposed in January of 2008, in order to avert the recession. Although a similar stimulus plan had been attempted in 2001, and failed to prevent a recession, Congress was compelled to it try again. By the time the checks reached taxpayers, in April of 2008, it was too late, the recession had commenced.

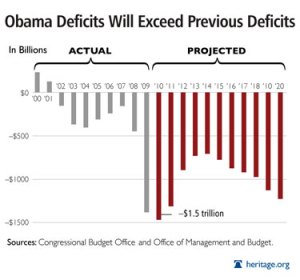

In February of 2009 President Obama enacted a second stimulus plan. What was that about? Was he trying to prevent something that had already occurred? The Obama stimulus plan occurred more than a year after it was originally called for. By the time Congress passed Obama’s stimulus plan, the economy was well in the midst of recession. The only purpose of an economic stimulus is to avert a recession. Once an economy is in recession, a whole new set of policies is required. As of this month, around nineteen months after Obama’s first failed stimulus program, and nearly 2 1/2 years after Bush’s tardy attempt, Obama is still talking about a stimulus plan. Isn’t this just economic flimflam?

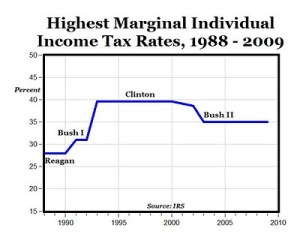

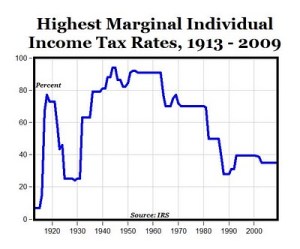

It should be obvious by now that stimulus programs don’t work in the real world. Although the classroom theory is plausible, the federal government is not an efficient vehicle for carrying one out. What should also be obvious is the type of recovery policies that work, once a recession has occurred. The 2003 Bush Tax Cuts and the 1983 Reagan Tax Cuts were effective tools in creating economic expansions following severe recessions.

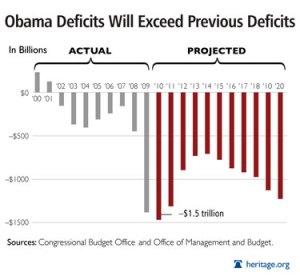

If the goal is to grow the economy, create jobs, and increase tax revenues, then tax cuts are the way to go. However, if the goal is to flush trillions of borrowed dollars down the drain by attempting something that’s untimely and proven to fail, then maybe that’s Obama’s fate. Obama’s first stimulus plan was untimely and proven to fail, a kind of Flimflam Economics. And even today, he is talking about another economic stimulus program. Again, is Obama trying to prevent something which has already occurred? Does Obama really have the best interests of America at heart?

Stimulus: The Need for Speed

In a January 20, 2008 Dow Jones News article entitled, “The Need for Speed”, it was stated that, “A plan out of Washington to stimulate the flagging US economy may be a day late, but it certainly isn’t a dollar short.” Two days earlier, President George W. Bush called for fast tax relief for individuals and tax incentives for businesses that would total up to $150 billion.

Economists said that would be enough of a jolt to have a notable impact on growth, if done right and quickly. Bush said the tax relief for consumers could be a “shot in the arm to keep a fundamentally strong economy healthy.” Bush’s rough draft proposal highlighted the US economy’s big problem: the consumer.

“Americans could use this money as they see fit: to help meet their monthly bills, cover higher costs at the gas pump or pay for other basic necessities,” the president said.

Bush wasted no time announcing the rescue plan after getting a firm nod of approval Thursday from the country’s pre-eminent economic policymaker, Fed Chairman Ben Bernanke. The central bank chief said he would approve of such a fiscal stimulus plan so long as it was “timely” and implemented “decisively” and “quickly.”

The need for speed in such a plan is no doubt important, as Bernanke pointed out Thursday. If Congress dilly-dallies on the matter, rebate checks may not arrive to consumers in time to fortify the weak economic growth that is likely to continue throughout 2008.

Lakshman Achuthan, managing director of the Economic Cycle Research Institute in New York, said the fiscal plan essentially calls for “throwing a ‘money wrench’ into the system.” That plan, he said, can be successful, but he said rebate checks need to start arriving in “the next few weeks.”

Democrat Congress Drags Feet

Now scroll forward to a March 21, 2008, Financial Week article entitled, “U.S. can’t avoid recession, says influential forecaster”. The subtitle reads, “Economic Cycle Research Institute claims economy ‘on a recessionary course’; blames Congress for tardy rebate checks.”

Mr. Achuthan argued that this recession could have been averted had Congress considered “innovative ways” to get tax rebates into consumers’ hands sooner. (The rebates still have not begun to reach taxpayers). “Following a presidential initiative, Congress passed a tax rebate package with unusual speed, as officials noted that time was of the essence,” he wrote, “but they were content to let the rebates start reaching consumers several months later.”

Choosing Recession

Moving forward to an April 21, 2008, Forbes article entitled, “Choosing Recession”, Lakshman Achuthan and Anirvan Banerji stated, “This recession was actually avoidable as recently as several weeks ago.” They added, “The 2008 recession guarantees many months of job losses that will boost foreclosures and feed the credit crisis. But if fiscal stimulus had reached consumers quickly, it would have forestalled a recession, helping to stabilize the housing market. Such a soft landing would have bought some breathing room in which to resolve the credit crisis until the lagged effect of monetary policy kicked in.”

They continued, “Policy makers seemed to get the urgency. In January, Treasury Secretary Hank Paulson declared that “time is of the essence.” House Speaker Nancy Pelosi spoke of “timely, targeted and temporary” stimulus, and the administration and Congress enacted a tax rebate package with exemplary speed. The fatal flaw was their willingness to allow a delayed delivery of the stimulus. It was as if the medics had arrived and taken a quick decision to administer CPR–but in a few months rather than a few seconds.”

Stimulus Arrives Late

Later, an April 28, 2008 report on CNN Money summed it up, in an article entitled, “U.S. can’t avoid recession, says influential forecaster”. Tax rebates had started to arrive in bank accounts. But many economists we’re doubtful that they would keep the economy from recession. The stimulus package was to give rebates to about 130 million Americans, at a cost of more than $110 billion. Married taxpayers earning $150,000 or less were to receive up to $1,200, while single taxpayers earning under $75,000 would get up to $600. But it was too late.

“This will not avert a recession, because it is too late,” said Lakshman Achuthan, the managing director of the Economic Cycle Research Institute. “For this to have kept us out of what was an avoidable recession, it needed to happen a couple of months ago, in January or February.”

Obama’s Plan: A Year Late and $900 Billion Short

Months later appeared a November 22, 2008 article by NPR entitled, “Obama Offers Plan to Revive Economy“. The author lead with, “President-elect Barack Obama set out plans for an ambitious economic stimulus that would create 2.5 million jobs by January 2011”.

“We’ll put people back to work rebuilding our crumbling roads and bridges, modernizing schools that are failing our children, and building wind farms and solar panels, fuel-efficient cars and the alternative energy technologies that can free us from our dependence on foreign oil and keep our economy competitive in the years ahead,” he said.

In the same November 22, 2008 NPR article, business and economics historian John Steele Gordon stated that, “the New Deal didn’t end the Great Depression, World War II did.” He added that “building bridges and painting schools won’t provide a quick fix.” He was right. The Great Depression lasted from 1929 until 1945, or around 15 years, and it didn’t end through the action of any clever government policy.

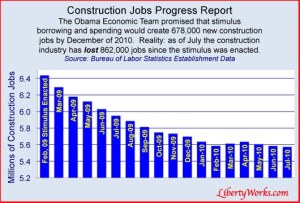

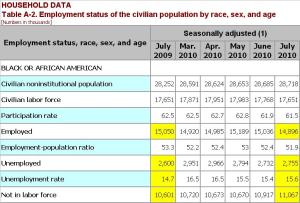

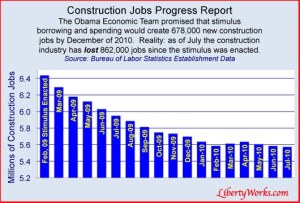

According to Liberty Works, the Obama Economic Team promised that stimulus borrowing and spending would create 678,000 new construction jobs by December of 2010. However, by July of 2010, the construction industry had actually lost 862,000 jobs.

Tax Cuts Work

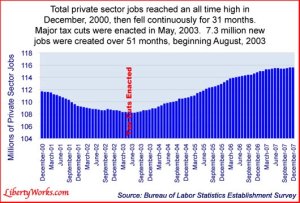

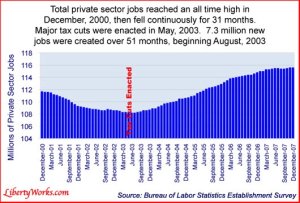

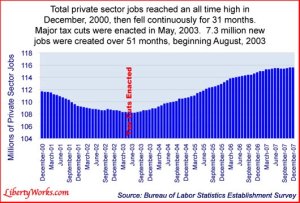

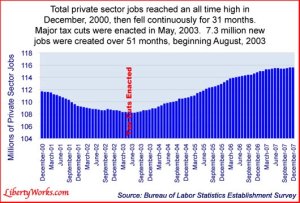

During the 2001 economic recession, the government attempted an economic stimulus in the form of tax rebates (similar to the 2008 rebates), but it likewise failed. Then finally in May of 2003, the Bush tax cuts were enacted. The tax cuts were responsible for the creation of 7.3 million new jobs beginning in August of 2003 and lasting through the end of 2007. Tax cuts are the only proven method for bringing an economy out of recession. The deeper the tax cut, the greater the expansion.

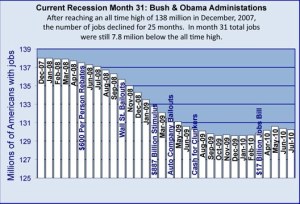

As the website Liberty Works so aptly reminds us, “President Obama and the Democrat Congress have implemented a series of measures that defy the lessons of past recessions”, especially that of 1981, which was by some measures worse than this one.

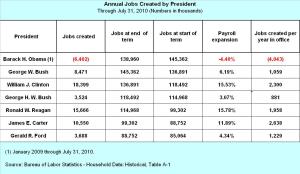

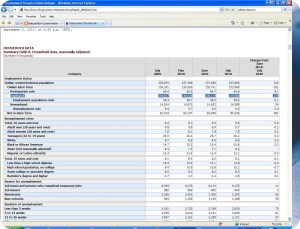

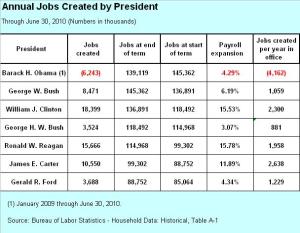

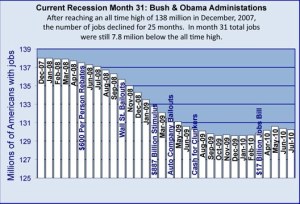

The chart above shows, “the job market recovery is faltering at best, after 31 months of Bush/Obama policies. There are 8 million fewer Americans now employed than in December, 2007.”

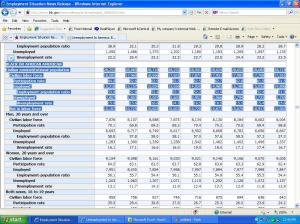

The results in the second chart (above), speak for themselves. “Reagan’s policies turned the job market around after 16 months of losses. The Reagan economy grew continuously for 90 months, creating a total of 21 million new jobs, or a 24% increase in the number of Americans who were employed.”

You’ve Been Flimflammed

If the goal is to grow the economy, create jobs, and increase tax revenues, then tax cuts are the way to go. However, if the goal is something more sinister, then one must brainwash their constituents into believing that ‘tax cuts cause recessions’. The Bush tax cuts brought us through another successful business cycle. Then the housing bubble burst, credit markets froze, and we fell back into recession. But tax cuts didn’t cause the recession. I don’t mind cutting Bush to pieces where warranted, and I was doing just that in 2007/08, but to say that the Bush tax cuts didn’t work because you disagree with his foreign policy is ignorant.

Whether or not the recession could have been avoided is highly doubtful due to the severity of the housing bubble and credit crisis. Yet if you listen closely, a year ago Obama was saying the recession was caused by the ‘lack of affordable health insurance’, and today he’s saying that it was caused by the ‘Bush tax cuts’. I suppose next he’ll be saying the recession was caused by whatever supports the legislation du jour.

It’s sinister enough to take advantage of a crisis in order to pass an unwanted legislative agenda. It’s entirely another matter to purposefully prolong a crisis to the detriment of every American: black, white, red, yellow, and brown; Democrat, Republican, and Independent. In fact, Obama’s looking more and more like another FDR. In FDR’s policies prolonged Depression by 7 years, UCLA economists calculate, you will find the following quote: “We found that a relapse isn’t likely unless lawmakers gum up a recovery with ill-conceived stimulus policies.”

Congress needs to cut spending, and cut taxes, now. If you’re not part of the solution, you’re part of the problem.