Lower Rates Across The Board

:: By: Larry Walker, II ::

Here’s an excerpt from Donald Trump’s Tax Plan which may be found on his official website www.donaldjtrump.com :

TAX REFORM THAT WILL MAKE AMERICA GREAT AGAIN

The Goals of Donald J. Trump’s Tax Plan

Too few Americans are working, too many jobs have been shipped overseas, and too many middle class families cannot make ends meet. This tax plan directly meets these challenges with four simple goals:

Tax relief for middle class Americans: In order to achieve the American dream, let people keep more money in their pockets and increase after-tax wages.

Simplify the tax code to reduce the headaches Americans face in preparing their taxes and let everyone keep more of their money.

Grow the American economy by discouraging corporate inversions, adding a huge number of new jobs, and making America globally competitive again.

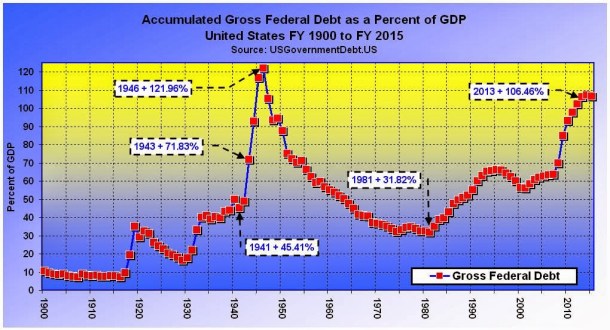

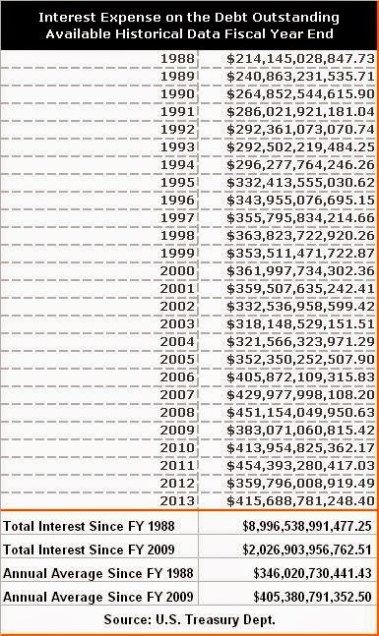

Doesn’t add to our debt and deficit, which are already too large.

The Trump Tax Plan Achieves These Goals

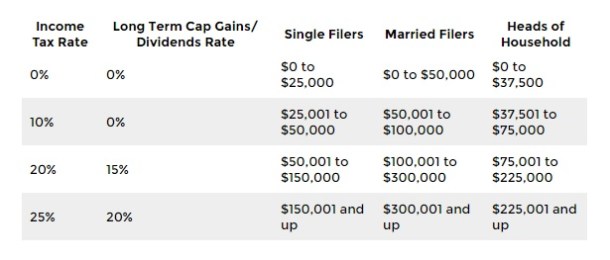

If you are single and earn less than $25,000, or married and jointly earn less than $50,000, you will not owe any income tax. That removes nearly 75 million households – over 50% – from the income tax rolls. They get a new one page form to send the IRS saying, “I win,” those who would otherwise owe income taxes will save an average of nearly $1,000 each.

All other Americans will get a simpler tax code with four brackets – 0%, 10%, 20% and 25% – instead of the current seven. This new tax code eliminates the marriage penalty and the Alternative Minimum Tax (AMT) while providing the lowest tax rate since before World War II.

No business of any size, from a Fortune 500 to a mom and pop shop to a freelancer living job to job, will pay more than 15% of their business income in taxes. This lower rate makes corporate inversions unnecessary by making America’s tax rate one of the best in the world.

No family will have to pay the death tax. You earned and saved that money for your family, not the government. You paid taxes on it when you earned it.

Again, this is only an excerpt; you may read the rest of Trump’s detailed tax plan on his website: Trump – Make America Great Again!

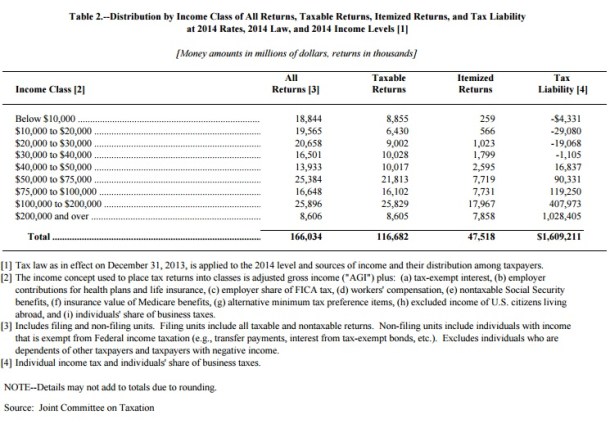

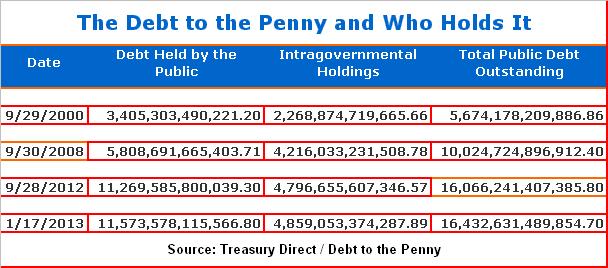

Under the Trump Plan, those in the lowest quintile, and most in the second and third quintiles (depending on marital status) won’t pay any income taxes at all. This is brilliant, considering that as a whole it’s estimated that those making less than $50,000 currently receive back roughly $37 billion more from the government, each year, than they pay in (see table below). This is due to a series of redundant, and costly tax expenditures. Removing upwards of 75 million households from filing requirements actually amounts to savings of no less than $370 billion, in government speak.

When it comes to simplifying the tax code, eliminating the filing requirements of some 75 million households turns out to be a big money saver. It will directly reduce the processing and subsequent examination, by the Internal Revenue Service, of around half of all tax returns currently filed. Since most individuals under this threshold only file to receive refundable tax credits, or to determine that they don’t owe any taxes at all, and around 37% of all individual returns audited involve the Earned Income Credit, once Trump’s plan is implemented the size of the IRS may be reduced dramatically.

Under Trump’s plan, if you are single, the first $25,000 you earn won’t be taxable, and if you are married, the first $50,000 you earn will be exempt from taxes (see table below). This will amount to a huge tax cut for the many, at the expense of a few. Compared to Dr. Ben Carson’s idea, where the government would get up to $2,500 or $5,000 from the same, Trump’s plan is a huge windfall for the working poor and middle class. Are you for lower taxes? Will this help you?

Trump’s plan lowers the top marginal tax rate to 25%, or to the same level imposed from 1925 to 1931 under the 1924 Mellon Tax Bill. So this is not a shot in the dark, but rather a return to policies the U.S. had in place during the Roaring Twenties, back when the country truly was great. Compared to the present tax code, Trump’s plan will reduce income taxes for a married couple making $85,000 per year from around $8,800 to just $3,500 (assuming 2015 taxable income of $65,000). Does this appeal to you? Is there some part of this plan that you don’t comprehend?

According to Trump, the huge reduction in rates will make many of the current exemptions and deductions unnecessary or redundant. “Those within the 10% bracket will keep all or most of their current deductions. Those within the 20% bracket will keep more than half of their current deductions. Those within the 25% bracket will keep fewer deductions. Charitable giving and mortgage interest deductions will remain unchanged for all taxpayers.”

Trump’s tax plan also reduces corporate taxes from a top rate of 39% to just 15%, making the U.S. one of the most attractive places to do business worldwide. But then he goes a step further, by applying the same 15% cap to income earned by freelancers, sole proprietors, unincorporated small businesses and pass-through entities (i.e. partnerships and S-corporations), which are all taxed at the individual level. According to Trump, these lower rates will provide a tremendous stimulus for the economy, as in significant GDP growth, a huge number of new jobs and an increase in after-tax wages for workers.

Finally, Mr. Trump’s plan eliminates the death tax, reduces or eliminates deductions and loopholes available to the wealthy, phases out the tax exemption on life insurance interest for high-earners, ends the current treatment of carried interest for speculative partnerships, adds a one-time repatriation of corporate cash held overseas at a discounted 10% tax rate, ends the deferral of taxes on corporate income earned abroad, and reduces or eliminates corporate loopholes that cater to special interests.

Coupled with his well aired balanced trade initiative, which seeks to eliminate our ongoing trade deficits with China, Mexico, Japan and other nations, every true Conservative is forced to concede that Donald Trump has a viable, solidly conservative, plan for this economy, and is indeed a serious candidate. Like him or not, when you lay Donald Trump’s tax reduction plan next to any other candidate’s, it’s clear that his plan will have the greatest positive impact on 99% of all Americans. No other plan comes close. It’s time for the mainstream media to stop focusing on the small stuff, and begin taking Trump and his policies seriously.

Related:

2016 Conservative Tax Plans: Trump vs. Carson

Top GDP Growth Rates in U.S. History