Tax Rates, GDP, and Static Retrogression

– by: Larry Walker, Jr. –

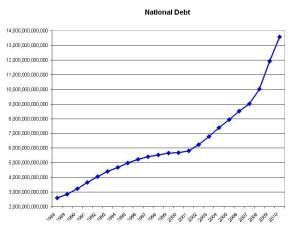

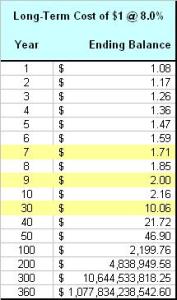

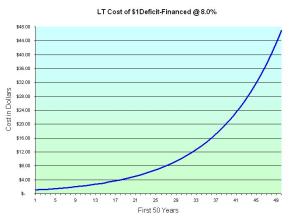

Those immersed in the static conception of human behavior say that America will never grow its way out of debt. Well, that’s a self-fulfilling prophecy if we base our tax policy on the static view. So do they think we can tax our way out of debt? If that’s the case, we might as well extend unemployment benefits indefinitely, and break out the hot dogs and beans. But there is another conception, known as the dynamic view. Dynamic analysts know that lower tax rates have positive impacts on human behavior, investment, production, economic growth, and tax receipts. Those of us who are faithful to the dynamic conception of human behavior believe it is better to grow our way out, than to surrender.

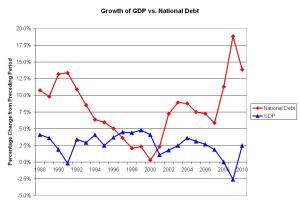

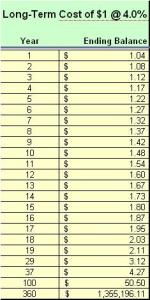

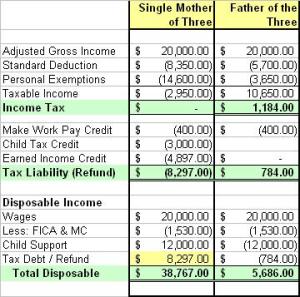

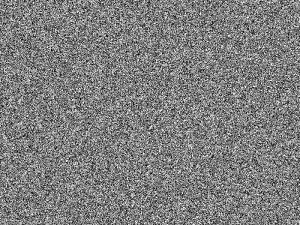

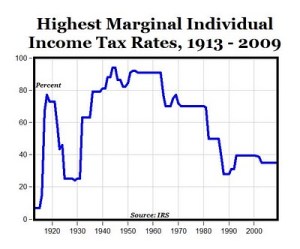

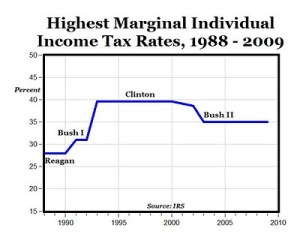

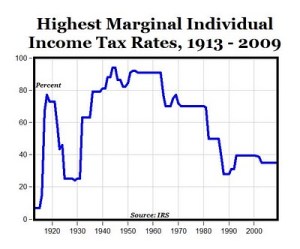

Today’s top income tax rate of 35.0% is relatively low in terms of a top rate of 39.6% during the 1990’s, but relatively high compared to rates of 7.0% in 1913, 24.0% in the 1920’s, and 28.0% in the 1980’s. A careful analysis of gross domestic product (GDP), during the highest and lowest tax rates of the past 30 years, reveals that cumulative GDP growth was 45.7% (.26/.569) higher when the lowest tax rates were imposed. Based on economic data available from the Bureau of Economic Analysis, it appears that a top tax rate of 28.0% is optimal (and that’s including the tax expenditures available in the 80’s). So today, we’ll look at relative tax rates, then analyze the performance of GDP and government revenues at relatively low and high tax rates, and then try to figure out what Obama is talking about.

Relative Tax Rates

As Mark Perry points out, in Tax Cuts, Tax Hikes, It’s All Relative; tax cuts and tax hikes are indeed relative. “…Certainly, compared to the “Clinton tax hikes” that took effect in 1993 and raised the top marginal income rate to 39.6%, the reductions of the top tax rate to 38.6% in 2002 and 35% in 2003 were “tax cuts”. But if you go back further and compare the Bush tax rates to the highest marginal tax rates under Bush, Sr. (31%) and Reagan (28%), couldn’t the Bush II tax rates more accurately be referred to as the “Bush tax hikes”?

“Of course, the tax rates were much higher before 1988, here’s the full history back to 1913 in the chart below. Compared to most of the tax rates between the 1930s and the 1980s, couldn’t the Clinton tax rates also accurately be referred to as the “Clinton tax cuts”?”

Sure it’s all relative, but what’s the optimal rate? In order to find the answer, we need a measurement.

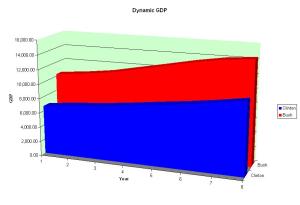

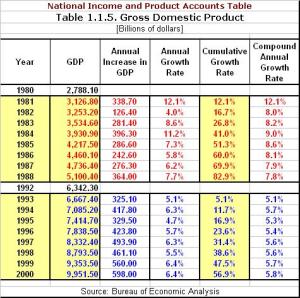

Cumulative GDP Growth and Tax Rates

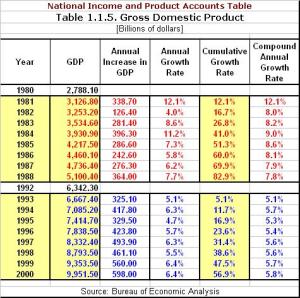

An analysis of the cumulative growth of GDP for the periods of 1981 to 1988, and 1993 to 2000 reveals that with top tax rates capped at 28.0%, GDP grew at a cumulative rate of 82.9%; and that when top tax rates rose to 39.6%, GDP only grew by 56.9%. This refutes the myth that the economy performed better under Clinton’s burdensome tax rates. The economy performed better than when? In reality, the economy grew at a much higher rate under Reagan, in fact 45.7% greater (see the table and chart below).

A top marginal tax rate of 28.0% is optimal.

Why did the economy perform so much better with lower tax rates? The answer may have something to do with behavioral psychology. Let’s face it, there’s a big difference between knowing that ones top tax rate will be under 30.0%, versus essentially 40.0%. Perhaps human behavior is both conditioned and determined by its own outcomes or consequences (rewards and punishments). As a commenter recently remarked, “My first customer, like my last, responded to stimuli that benefited him and his business, and at the best possible price.” And what are income taxes, if not a price?

The difference between top tax rates of 28.0% and 39.6% can be reasonably quantified as a cost, or benefit, of 45.7% in cumulative economic growth, over an eight-year period. The effect of tax policies on GDP is but one aspect of a dynamic tax policy. Lower tax rates lead to increased economic activity, and eventually to greater tax revenues.

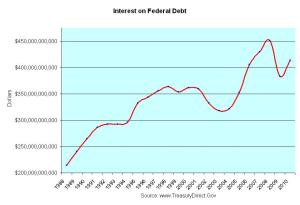

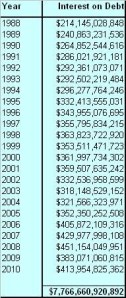

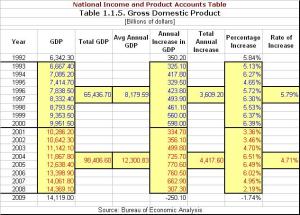

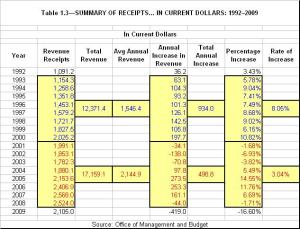

Growth in Government Revenue and Tax Rates

In terms of government revenues, tax receipts grew at a cumulative rate of 75.8% during the 80’s, and at 85.6% during the 90’s. In other words, Clinton’s tax policies increased tax revenue by 12.9% more than Reagan’s (see table below). But when we bring GDP back into the picture, we see that Clinton’s policies actually grew tax receipts by 50.4% more than GDP, while Reagan’s policies increased GDP by 9.4% more than revenue.

Under Clinton, government revenue grew at 85.6%, while GDP only managed 56.9%. Under Reagan GDP grew by 82.9%, while revenue increased by 75.8%. So which top tax rate is optimal? Although a top tax rate of 39.6% increased tax revenues by 12.9% more than a top rate of 28.0%, the cost to our economy was a loss of 45.7% in cumulative GDP growth. Again, a top tax rate of 28.0% is optimal. Think about it. What happens to you when your tax burden increases significantly faster than your personal income? Yeah, not a good thing; yet many idolize Clinton. And then there’s Obama, who not only wants to raise top rates back to 39.6%, but also to reset the top tax bracket to where it was 17 years ago. What’s up with that?

Obama’s Retrogression: Why $250,000?

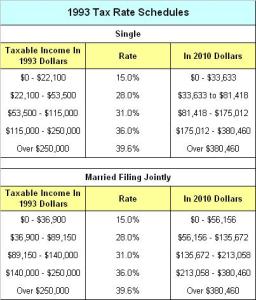

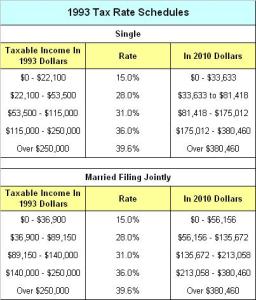

Now that we know for sure that capping top tax rates at 28.0% leads to optimal economic and revenue growth, and that raising rates to 39.6% causes tax revenues to outpace the economy by 50.4%, the question is: What does $250,000 have to do with it? Well, a quick examination of the 1993 tax rate schedules reveals that the top tax bracket back then, seventeen years ago, was $250,000 (see table below).

Why is Obama regressing when it comes to the top tax bracket? He keeps saying he’s moving ‘forward’, and ‘making progress’, yet when it comes to income tax brackets, he wants to put it in reverse. If that is indeed his intent, then the major flaw in Obama’s appraisal is that he has failed to adjust for inflation. In real terms, $250,000 of income today was equal to just $164,275 in 1993 (calculate it here). And, $250,000 earned in 1993 is the equivalent of $380,460 today. Annual inflation over the 17-year span has been 2.5%. In fact, the top tax bracket today would be $380,460 if properly adjusted for inflation, and yet in 2010 it is $373,650 (the same as in 2009).

So Obama’s proposal boils down to taxing those with current incomes of $250,000, in 1993 dollars, without the benefit of an inflation adjustment, while taxing everyone else in current dollars. And if approved, it will result in nothing more than ‘legalized theft’. In effect, taxpayers who made between $164,275 and $250,000 in 1993 would be pushed into the top tax bracket by 2011. If Obama was playing it straight, he would simply let the Bush tax cuts expire. But instead, we are being asked to tolerate the idea that some taxpayers deserve the benefit of an inflation adjustment, while others do not.

However, Obama’s static retrogression is implausible. If the imposition of a top tax rate of 39.6% were optimal for our economy, then Obama’s approach might be practical, however, in light of the facts, it is most unsuitable. History proves that our economy achieved maximum growth when top tax rates were limited to 28.0%. The difference amounted to a 45.7% increase in cumulative GDP growth over an eight-year period. Obama’s strategy of lowering the bar of the top income bracket, while raising the top tax rate will cost our economy more than 45.7% in cumulative growth over the ensuing eight years, as more taxpayers get bilked.

At a time when America really needs an across the board tax rate cut, Americans are being asked to accept higher taxes, and regressive income brackets. If we are dumb enough to accept Obama’s proposal, in time we will achieve what many long for, a flat-rate-tax. But unfortunately the rate will wind up being 39.6% for all who are fortunate enough to endure. We can do this, but we need to be dynamic. Don’t get stuck on static. Cut spending, lower taxes, step back, quit lecturing, and for God’s sake stop chanting.

In the beginning it was:

Yes we can!

Yes we can!

Yes we can!

Then those chants quickly evolved into:

Yes government can!

Yes government can!

Yes government can!

And just before fizzling into dead silence, it was:

More for government, less for us!

More for government, less for us!

More for government, less for us!

Now that this foolishness has been exposed, and a line has been drawn, the question is: Which side are you on? Do you side with the people, or with the government? You can’t be for both. Either you are in favor of keeping more of your hard earned pay, or you are for handing over more to the government. Either you are for individual freedom and personal responsibility, or more government control. You are either for you, or against yourself.

Prerequisites: Tax Reform 101: Stuck on Static; Obama’s Inverted Wealth Curve

Data Sources: Bureau of Economic Analysis; Office of Management and Budget