A Tax Credit in Name Only (TCNO)

– By: Larry Walker, II –

A couple of weeks ago I wrote about how during this year’s continuing education courses it suddenly dawned on me that the base amounts used in calculating the taxability of social security benefits are exactly the same in tax year 2012 as they were in 1985. Well here’s another example of elder abuse. Congress has failed to inflation adjust the limitations on the Credit for the Elderly or the Disabled since it was last upgraded back in 1984. I am frankly surprised that this credit is still around, since in its present form it’s completely useless to 99.999% of taxpayers. Why is it still taking up space in IRS instruction booklets?

Back in 1981, when my study of tax law began, it was known simply as the Credit for the Elderly. It initially applied to persons over the age of 65, or under 65 if they had taxable income from a public retirement system. In tax year 1984 it became known as the Credit for the Elderly and the Permanently and Totally Disabled. It was also in 1984 that the same limitations that are in place today were established. Since 1988 it has been known simply as the Credit for the Elderly or the Disabled.

Although it sounds appealing, due to the failure to adjust for inflation, it has become a tax credit in name only (i.e. completely useless). How’s that, you say? Well, like I said, its name may have changed over the years, but the initial amounts and income limitations have not.

Maximum Credit

The maximum amount of the credit is limited to 15.0% of the following initial amounts, based on one’s filing status. (Note: For the disabled, the initial amounts used in calculating the tax credit cannot be more than the amount of the taxpayer’s taxable disability income.)

-

$5,000 if Single, Head of Household or Qualifying Widow(er)

-

$7,500 if Married Filing Joint and both spouses qualify

-

$5,000 if Married Filing Joint and only one spouse qualifies

-

$3,750 if Married Filing Separate and you did not live with your spouse at any time during the tax year.

Thus, on paper, the maximum amounts of this nonrefundable tax credit (at 15.0% of the initial amounts) are limited to the following:

-

$750 if Single, Head of Household or Qualifying Widow(er)

-

$1,125 if Married Filing Joint and both spouses qualify

-

$750 if Married Filing Joint and only one spouse qualifies

-

$562.50 if Married Filing Separate and you did not live with your spouse at any time during the tax year.

Since this is a nonrefundable tax credit, even if you are magically somehow able to qualify, you can only actually use the credit if you have a regular income tax liability. In other words, the credit cannot be used to offset self-employment taxes, penalties on retirement distributions, or other taxes found on lines 56 to 60 of Form 1040. The credit is figured on Schedule R and entered on line 53 of Form 1040.

Limitations

It sounds fantastic, and maybe it was in 1984. But since hardly anyone can qualify for the credit anymore, it’s really meaningless today. The main problem here is that the same income limitations in place in 1984 are in effect in 2012. So who can qualify today?

If your adjusted gross income (AGI) is equal to or greater than the following amounts, then you do not qualify for the tax credit.

-

$17,500 if Single, Head of Household or Qualifying Widow(er)

-

$25,000 if Married Filing Joint and both spouses qualify

-

$20,000 if Married Filing Joint and only one spouse qualifies

-

$12,500 if Married Filing Separate and you did not live with your spouse at any time during the tax year.

Additionally, if the nontaxable part of your Social Security and other nontaxable pensions is greater than the following amounts, you are also excluded from the credit. No, really.

-

$5,000 if Single, Head of Household or Qualifying Widow(er)

-

$7,500 if Married Filing Joint and both spouses qualify

-

$5,000 if Married Filing Joint and only one spouse qualifies

-

$3,750 if Married Filing Separate and you did not live with your spouse at any time during the tax year.

Finally, if one-half of your Excess Adjusted Gross Income (defined as adjusted gross income minus the following limits), plus the nontaxable portion of your pensions is greater than the initial amount of the credit, you are also disqualified.

-

$7,500 if Single, Head of Household or Qualifying Widow(er)

-

$10,000 if Married Filing Jointly

-

$5,000 if Married Filing Separate and you did not live with your spouse at any time during the tax year.

In other words, you must reduce the initial amount of the credit, by one-half of your Excess AGI and your total nontaxable pensions.

The Problem

Think inflation. The average monthly Social Security benefit for a retired worker was about $1,230 at the beginning of 2012. So a single retiree with an average benefit would receive around $14,760 per year. A married couple with an average benefit would receive around $29,520 per year. So with that, let’s see whether or not it’s even possible to qualify for this tax credit.

Example 0: Let’s say you are single, over the age of 65, and receive social security benefits of $14,760. Since social security isn’t taxable until half of your social security plus your other income (both taxable and tax exempt) exceeds $25,000, if that is your only source of income, then none of it is taxable, and the Credit for the Elderly or the Disabled doesn’t apply. So let’s try to figure out the precise circumstances under which the credit does apply.

-

In order for 50% of your social security benefits to be taxable, your income from other sources (both taxable and tax exempt) must be greater than $17,620 [17,620 + 7,380 (½ of social security benefits) = $25,000].

a) But if this is the case, then your adjusted gross income is also likely to be more than the AGI limit of $17,500, so you will not qualify for the credit.

b) And since only half of your social security is taxable, because the nontaxable portion of $7,380 (14,760 / 2) is greater than the $5,000 limit for nontaxable pensions, you don’t qualify.

c) Also, since your adjusted gross income is likely greater than $17,500, subtracting the limit for excess adjusted gross income of $7,500 leaves $10,000, which when divided by 2 is equal to or greater than the initial amount of $5,000, which means you don’t qualify. Got it?

-

In order for 85% of your social security benefits to be taxable, your income from other sources (taxable and tax exempt) must be greater than $26,620 [26,620 + 7,380 (½ of social security benefits) = $34,000]. But then, you are also likely disqualified due to both (a) and (c) under #1 above. Got that?

-

And there’s another problem. Because the standard deduction for a single person over the age of 65 in 2012 is $7,400 [5,950 + 1,450], and the personal exemption allowance is $3,800, your adjusted gross income must be greater than $11,200 to even have an income tax liability. In other words, if your adjusted gross income is under $11,200, you don’t qualify. But if your AGI is between $11,200 and $17,500, and the nontaxable portion of your social security benefits is less than $5,000 (item #1 (b)), then you might qualify.

a) However, if your AGI is between $11,201 and $17,499, then in this example, the nontaxable portion of your social security benefits will be greater than $5,000 which disqualifies you under item #1 (b).

-

Even if you don’t receive social security, and the nontaxable portion of your other pension income is less than the $5,000 limit, when calculating the credit, you must then subtract one-half of your excess AGI plus your nontaxable pensions, from the initial credit amount, in order to determine your limited tax credit. So at the low end, your Excess AGI would be $3,700 (11,200 – 7,500), and at the high end it would be $10,000 (17,500 – 7,500). But this poses further problems.

a) The initial amount of your tax credit is limited to $5,000, but this must be further reduced by one-half of your excess AGI, which will either be $1,850 (3,700 / 2) at the low end, or $5,000 (10,000 / 2) at the high end, plus the nontaxable amount of your pensions (i.e. up to $5,000). So at the low end, assuming a nontaxable pension of $5,000, the initial amount of your credit is limited to -0- (5,000 – 1,850 – 5,000), and at the high end it is also reduced to -0- (5,000 – 5,000 – 5,000).

-

Finally, if none of your income is from social security, you don’t have any other nontaxable pensions, and assuming all other criteria are met, then in order to qualify for the tax credit, the adjusted gross income of a single taxpayer is limited to being between $11,201 and $17,499. Simple, right?

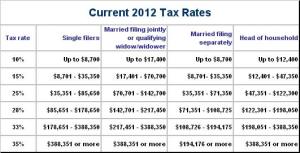

a) However, since the amount of the actual tax credit is further limited to 15.0% of the initial amount (after the reduction of one-half of excess AGI), the maximum amount of the credit can be no greater than $472.50 [(5,000 – ((11,201 – 7,500) / 2)) * 15.0%], and this would be further limited to the amount of income tax actually owed.

b) At the low-end, a single retiree with AGI of $11,201 qualifies for the maximum credit of $472.50 [(5,000 – ((11,201 – 7,500) / 2)) * 15.0%], but would have an income tax liability of $0 [(11,201 – 11,200) * 10.0%]. Thus, the credit is useless.

c) In the mid-range, a retiree with AGI of $14,350 would have a tax liability of $315 [(14,350 – 11,200) * 10.0%], and would qualify for a tax credit of $236 [(5,000 – ((14,350 – 7,500) / 2)) * 15.0%]. That would about cover the cost of calculating this monstrosity.

d) At the high-end, a retiree with AGI of $17,499 would have a tax liability of $630 [(17,499 – 11,200) * 10.0%], and would qualify for a tax credit of $0 [(5,000 – ((17,499 – 7,500) / 2)) * 15.0%]. Thus, the credit is once again useless.

Summary: In order for a single retiree to qualify for the Credit for the Elderly or the Disabled, his Adjusted Gross Income must fall between $11,201 and $17,499, and he must either not be on social security, or the nontaxable portion of his combined pension income must be less than $3,150 (5,000 – 1,850). The mid-range amount of the final tax credit for such a rare individual would be around $236 (between -0- and $472.50), while the maximum credit would only be available against an income tax liability of -0-. Thus, in order to qualify for the optimal credit, a single retiree would have to have an adjusted gross income of around $14,350, with no income from social security and no other nontaxable pension income.

The results for married couples and the disabled are similar. The example above is just a long way of proving that the Credit for the Elderly or the Disabled has become obsolete due to the failure of Congress to adjust its 1984 initial amounts and limitations for inflation.

Solution

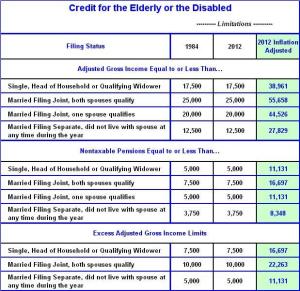

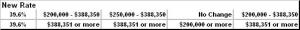

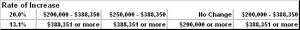

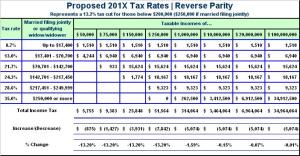

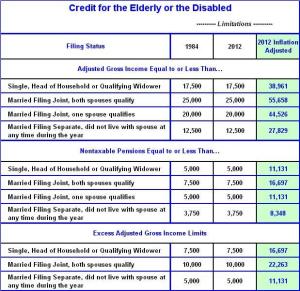

The table below shows the limitations in force in 1984 and 2012, along with the inflation adjusted amounts. As you can see, a simple inflation adjustment would more than double the income limitations, likely causing at least some elderly and disabled taxpayers to qualify. So why hasn’t this been done? Is it too hard, or has Congress simply forgotten?

The maximum amount of the credit would increase to 15.0% of the following initial amounts, based on filing status. (Note: For the disabled, the initial amounts used in calculating the tax credit cannot be more than the amount of the taxpayer’s taxable disability income.)

-

To $11,131 from $5,000 if Single, Head of Household or Qualifying Widow(er)

-

To $16,697 from $7,500 if Married Filing Joint and both spouses qualify

-

To $11,131 from $5,000 if Married Filing Joint and only one spouse qualifies

-

To $8,348 from $3,750 if Married Filing Separate and you did not live with your spouse at any time during the tax year.

Thus, on paper, the maximum amounts of the nonrefundable credit (at 15.0% of the initial amounts) would increase as follows:

-

To $1,670 from $750 if Single, Head of Household or Qualifying Widow(er)

-

To $2,505 from $1,125 if Married Filing Joint and both spouses qualify

-

To $1,670 from $750 if Married Filing Joint and only one spouse qualifies

-

To $1,252 from $562.50 if Married Filing Separate and you did not live with your spouse at any time during the tax year.

Now that’s more like it. It’s not all that, but it’s better than what we have today. Inflation Indexing should be an integral part of tax reform. It’s not right to screw our seniors and disabled out of a tax credit, when an automatic adjustment is granted in other areas of the tax code. We should have more respect for the elderly and disabled.

The following example is based on one used by the IRS. It calculates the tax credit before and after the proposed inflation adjustments:

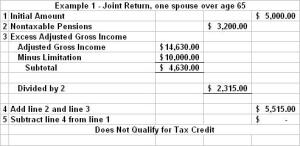

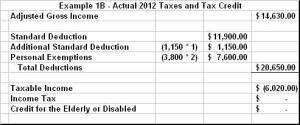

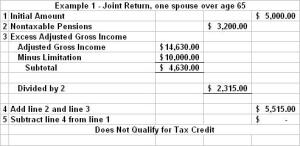

Example 1 (before) – You are 66 years old and your spouse is 64. Your spouse is not disabled. You file a joint return on Form 1040. Your adjusted gross income is $14,630. Together you received $3,200 from social security, which was nontaxable. You figure your credit as follows:

You cannot take the credit since your nontaxable social security (line 2) plus your excess adjusted gross income (line 3) is more than your initial amount on line 1.

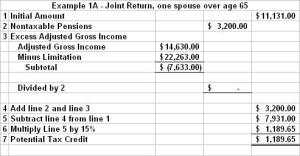

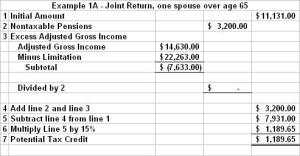

Example 1A (after) – The same circumstances as in example 1, except that all limitations have been adjusted for inflation.

Your potential tax credit is now $1,189.65 which will be limited by the amount of income tax shown on line 46 of your Form 1040 tax return.

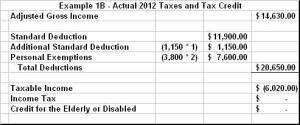

Example 1B – This is the income tax calculation for the couple in Examples 1 and 1A.

Since the sum of the taxpayers’ standard deduction, additional standard deduction for one spouse being over the age of 65, and the deduction for personal exemptions are greater than their adjusted gross income; the taxpayers’ do not have a tax liability. Thus, in this case, although they qualify for the tax credit in Example 1A, they are not able to, and do not need to use it. However, what’s changed is that after the inflation adjustment, the couple could potentially have up to $38,000 of adjusted gross income (or around $24,000 more than in the example) and still qualify for the tax credit.

Conclusion

The Credit for the Elderly or the Disabled is a Tax Credit in Name Only (TCNO). In its present state it is completely useless to 99.999% of Americans. It’s easier for a camel to go through the eye of needle than to qualify for this phantom credit. Its initial amounts and limitations should immediately be adjusted for inflation (although the numbers probably need a bit more tweaking). If Congress refuses to make these simple adjustments, then all references to this tax credit should be purged from the Internal Revenue Code, from all income tax forms and publications, and from the IRS’s computers. It costs money to print B.S., and frankly, it’s a waste of time to calculate and explain to a senior or disabled person why they are not qualified.

Related:

Taxing Social Security Taxes

#Taxes

References:

U.S.Inflation Calculator

2012 Schedule R

2000 Schedule R

1990 Schedule R

1985 Schedule R

1984 Schedule R

1983 Schedule R

1981 Schedule R

1980 Schedule R